Real Estate Investing in 2025: Is Now the Right Time to Buy?

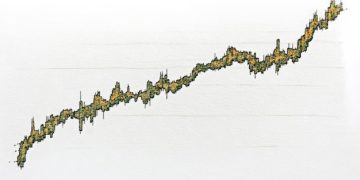

Real estate investing in 2025 presents both opportunities and challenges, requiring careful consideration of market trends, interest rates, and economic forecasts to determine if buying now aligns with individual investment goals and risk tolerance.

Navigating the real estate market is complex, especially when considering investments in the future. If you’re wondering whether Real Estate Investing in 2025: Is Now the Right Time to Buy? then this article will provide a comprehensive overview to help you make an informed decision.

Understanding the 2025 Real Estate Landscape

Predicting the future of real estate requires analyzing current trends and projecting them forward. What factors will shape the market in 2025, and how can investors prepare?

Several key elements will influence the real estate market in 2025. These include interest rates, economic growth, demographic shifts, and technological advancements. Understanding each factor is crucial for making informed investment decisions.

Interest Rate Forecasts

Interest rates significantly impact the affordability of mortgages and, consequently, the demand for housing. Monitoring forecasts from financial institutions and economists can provide insights into potential rate movements.

Economic Indicators

Key economic indicators, such as GDP growth, employment rates, and inflation, offer a broader perspective on the health of the economy and its potential impact on real estate.

- Demographic Shifts: Changes in population distribution and age demographics can influence housing demand in specific regions.

- Technological Advancements: Innovations in construction, property management, and real estate technology can reshape the industry.

- Regulatory Changes: New regulations and policies related to zoning, taxation, and environmental standards can affect property values and development opportunities.

In summary, understanding the interplay of these factors is vital for anyone considering real estate investments in 2025. By staying informed and analyzing market trends, investors can better assess the risks and opportunities that lie ahead.

Assessing Your Financial Readiness

Before diving into real estate investments, it’s paramount to evaluate your financial situation. Can you comfortably afford the costs associated with property ownership and management?

A comprehensive financial assessment includes evaluating your current income, savings, debt obligations, and credit score. This will help determine your ability to secure financing and manage ongoing expenses.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a critical metric lenders use to assess your ability to repay a mortgage. A lower DTI indicates a healthier financial position.

Credit Score

A good credit score is essential for securing favorable interest rates on a mortgage. Regularly monitoring and improving your credit score can save you money in the long run.

- Savings and Down Payment: Having a substantial down payment can reduce your loan amount and improve your chances of approval.

- Emergency Fund: Maintaining an emergency fund is crucial for covering unexpected expenses related to property ownership.

- Investment Goals: Aligning your real estate investments with your overall financial goals ensures a strategic approach to wealth building.

In conclusion, assessing your financial readiness is a critical first step in real estate investing. By addressing these factors, you can confidently approach the market with a clear understanding of your capabilities and limitations.

Identifying Promising Investment Locations

Location is everything in real estate. Which areas are poised for growth and offer the best potential returns in 2025?

Identifying promising investment locations involves researching demographic trends, job growth, infrastructure developments, and local amenities. Areas with strong economic fundamentals and positive growth prospects are more likely to yield profitable investments.

Areas with Job Growth

Regions experiencing significant job growth tend to attract new residents, increasing demand for housing. Focus on areas with diverse industries and a growing employment base.

Infrastructure Developments

Investments in transportation, utilities, and public services can enhance the desirability of a location and drive up property values.

- Demographic Trends: Areas with growing populations and favorable demographic shifts are often attractive for real estate investments.

- Local Amenities: Access to schools, healthcare facilities, shopping centers, and recreational areas can significantly impact property values.

- Property Taxes and Regulations: Understanding local property taxes and regulations is crucial for evaluating the overall cost of ownership and investment potential.

Ultimately, identifying promising investment locations requires thorough research and analysis. By carefully considering these factors, investors can increase their chances of finding properties with strong appreciation potential and rental income opportunities.

Exploring Different Investment Strategies

There are various approaches to real estate investing. Which strategy aligns best with your goals and risk tolerance?

Different investment strategies cater to various risk profiles and financial goals. Common strategies include buying and holding, flipping, rental properties, and real estate investment trusts (REITs). Understanding the pros and cons of each approach is essential for making informed decisions.

Buy and Hold

This strategy involves purchasing properties with the intention of holding them for the long term, benefiting from appreciation and rental income.

Flipping

Flipping involves purchasing undervalued properties, renovating them, and quickly reselling them for a profit.

- Rental Properties: Investing in rental properties can provide a steady stream of income and potential appreciation over time.

- Real Estate Investment Trusts (REITs): REITs allow investors to participate in the real estate market without directly owning properties.

- Wholesaling: This strategy involves finding properties at below-market prices and assigning the contract to another buyer for a fee.

In conclusion, exploring different investment strategies is vital for aligning your real estate investments with your goals. By carefully considering these options, you can choose the approach that best suits your needs and risk tolerance.

Analyzing Market Risks and Mitigation Strategies

Real estate investments come with inherent risks. How can you identify and mitigate these risks to protect your investments?

Analyzing market risks involves identifying potential factors that could negatively impact property values and investment returns. Common risks include economic downturns, rising interest rates, natural disasters, and changes in local regulations. Implementing mitigation strategies can help minimize the impact of these risks.

Economic Downturns

Economic recessions can lead to decreased demand for housing and lower property values. Diversifying your investment portfolio and maintaining a cash reserve can help mitigate this risk.

Rising Interest Rates

Increasing interest rates can make mortgages more expensive and reduce buyer demand. Consider fixed-rate mortgages to protect against rate fluctuations.

- Natural Disasters: Properties in areas prone to natural disasters are at higher risk of damage and loss. Obtaining adequate insurance coverage and implementing preventative measures can help mitigate this risk.

- Property Management Issues: Poor property management can lead to tenant turnover and increased maintenance costs. Hiring a professional property manager or implementing effective management practices can help mitigate this risk.

- Regulatory Changes: Changes in zoning laws, building codes, and environmental regulations can impact property values and development opportunities. Staying informed about local regulations and seeking expert advice can help mitigate this risk.

In summary, analyzing market risks and implementing effective mitigation strategies is crucial for protecting your real estate investments. By anticipating potential challenges and taking proactive measures, you can minimize the impact of adverse events and maximize your returns.

Leveraging Technology in Real Estate Investing

Technology is transforming the real estate industry. How can you leverage these advancements to improve your investment decisions?

Leveraging technology in real estate investing involves using digital tools and platforms to streamline property searches, analyze market data, manage properties, and communicate with tenants. These advancements can enhance efficiency, reduce costs, and improve decision-making.

Online Property Portals

Online property portals provide access to a vast database of listings, allowing investors to quickly search for properties that meet their criteria.

Data Analytics Tools

Data analytics tools provide insights into market trends, property values, and investment returns, helping investors make informed decisions.

- Virtual Tours: Virtual tours allow potential buyers and renters to view properties remotely, saving time and travel costs.

- Property Management Software: Property management software streamlines tasks such as rent collection, tenant screening, and maintenance requests.

- Blockchain Technology: Blockchain technology can enhance transparency and security in real estate transactions.

In conclusion, leveraging technology is essential for staying competitive in the modern real estate market. By embracing these tools and platforms, investors can enhance their efficiency, reduce costs, and improve their overall investment performance.

| Key Point | Brief Description |

|---|---|

| 📈 Market Analysis | Understand trends, interest rates, and economic forecasts. |

| 💰 Financial Readiness | Assess income, savings, and credit score before investing. |

| 📍 Location Matters | Identify areas with job growth and infrastructure developments. |

| 🛡️ Risk Mitigation | Analyze market risks and implement strategies to protect investments. |

Frequently Asked Questions (FAQ)

▼

Key factors include interest rates, economic growth, demographic shifts, and technological advancements. Monitoring these elements helps in making informed investment decisions.

▼

Evaluate your income, savings, debt obligations, and credit score. A healthy financial position is crucial for securing financing and managing property expenses.

▼

Consider buy and hold, flipping, rental properties, and REITs. Choose a strategy that aligns with your risk tolerance and financial goals for optimal results.

▼

Diversify your portfolio, maintain a cash reserve, and obtain adequate insurance coverage. Staying informed about market trends and local regulations is also essential.

▼

Technology enhances efficiency through online property portals, data analytics tools, and property management software. Virtual tours and blockchain also improve transparency and decision-making.

Conclusion

In conclusion, deciding whether Real Estate Investing in 2025: Is Now the Right Time to Buy? requires a thorough understanding of market dynamics, a careful assessment of your financial readiness, and a well-thought-out investment strategy. By staying informed and leveraging available resources, you can make informed decisions and position yourself for success in the ever-evolving real estate landscape.